NWS (NWS)·Q2 2026 Earnings Summary

News Corp Beats Q2 as Dow Jones Posts Record Margins, AI Deals Accelerate

February 5, 2026 · by Fintool AI Agent

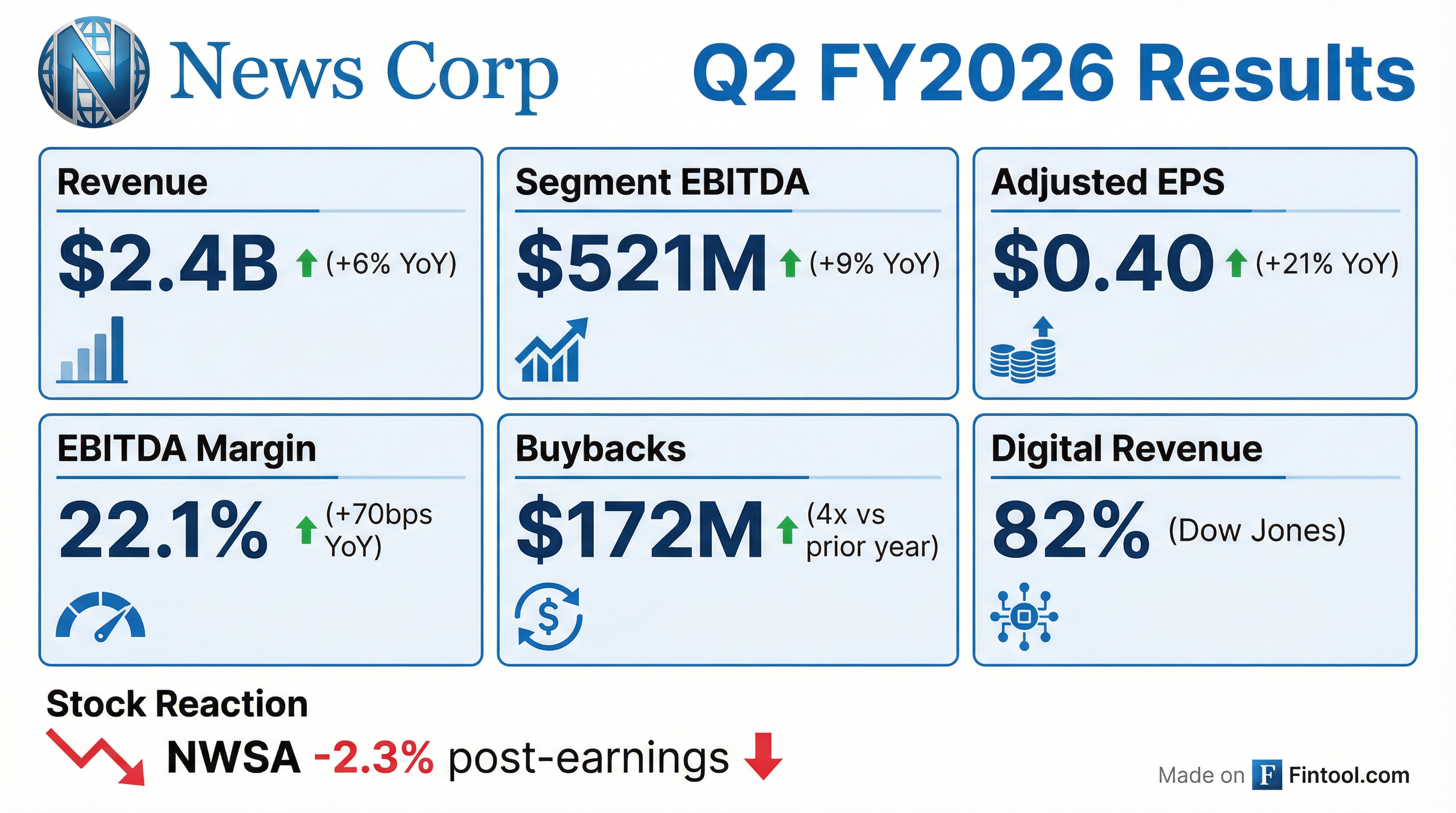

News Corp delivered strong Q2 FY2026 results with accelerating revenue and profitability growth across its three core pillars. Revenue rose 6% to $2.4 billion, total segment EBITDA expanded 9% to $521 million, and adjusted EPS jumped 21% to $0.40. This marks the company's eleventh consecutive quarter of year-over-year EBITDA growth.

The standout was Dow Jones, which posted its highest quarterly revenue growth in nearly three years and achieved a record 29.5% profit margin. CEO Robert Thomson struck a defiant tone on AI, arguing that News Corp's premium content creates a "moat with saltwater crocodiles, sharks, and even more dangerous species—lawyers" that separates it from commodity content.

Did News Corp Beat Earnings?

Yes. News Corp beat on both revenue and earnings:

*Net income decline reflects prior year's $87M gain from REA Group's PropertyGuru sale.

Key drivers of the beat:

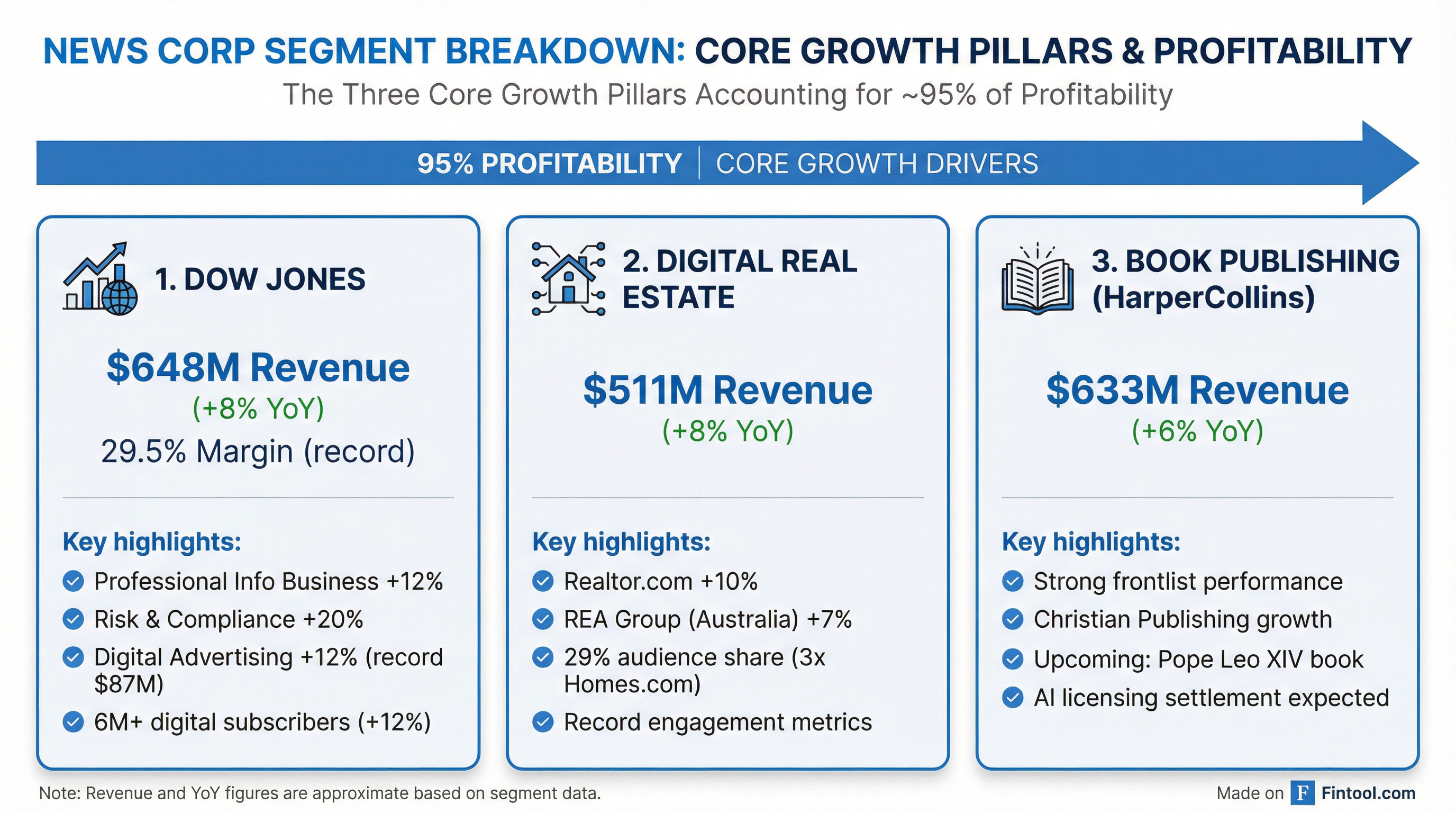

- Dow Jones posted double-digit EBITDA growth for the fourth consecutive quarter

- Digital Real Estate delivered double-digit profit growth

- HarperCollins revenue recovered with 6% growth after a sluggish Q1

How Did Each Segment Perform?

Dow Jones: Record Quarter

Dow Jones delivered exceptional results with revenue rising 8% to $648 million—the highest quarterly revenue growth in nearly three years.

Professional Information Business accelerated to 12% growth (200 bps faster than Q1):

- Risk & Compliance: +20% to $96M, driven by new customers and risk feeds/API solutions

- Dow Jones Energy: +10% to $75M, with ~90% customer retention

- Factiva: Modest growth, benefiting from GenAI customer acquisition

Consumer Business saw digital-only subscriptions grow 12% to over 6 million, led by enterprise partnerships. Digital circulation revenue rose 7% and now represents 76% of circulation revenues.

Digital Real Estate: Realtor.com Gaining Share

Digital Real Estate revenue grew 8% to $511 million with segment EBITDA up 11%.

On Homes.com competition, CEO Thomson was dismissive: "Homes.com is complicated. It's at least a fixer-upper, and while some people suggest that it's more of a knockdown, I think that comparison is a little unkind." CFO Chandrashekar noted Realtor.com has 3x the visits of Homes.com and 2x Redfin.

HarperCollins: Strong Recovery

Book Publishing revenue grew 6% to $633 million, a significant recovery from Q1's struggles.

Notable releases included Heated Rivalry (inspiring a streaming series), Senator John Kennedy's How to Test Negative for Stupid, and Mitch Albom's Twice. Upcoming titles include Pope Leo XIV's first book Peace Be With You.

News Media: California Post Launch

News Media revenues were flat at $570 million with EBITDA down 5% to $70 million, impacted by challenging print advertising and California Post launch investments.

Bright spots included:

- The Times/Sunday Times (UK): Digital subscribers +7% to 659K, record Q2 digital advertising

- News Corp Australia: 1.2M total subscribers (+4%)

- California Post: Launched January 2025, "bringing editorial enlightenment to the West Coast"

What Did Management Say About AI?

CEO Thomson delivered an emphatic defense of News Corp's AI positioning, calling it "a fundamental misconception" that AI threatens the company:

"AI is retrospective and synthesizes generic content, sometimes imperfectly, but is past tense, often past imperfect. We have contemporary, creative, proprietary content, which is only accessed if AI companies pay us."

Key AI developments:

- Anthropic Settlement: News Corp expects "a large chunk" of Anthropic's $1.5B payout for pirated books later in 2026

- OpenAI Partnership: Ongoing deal where "OpenAI expertise will enhance our editorial, business, and real estate products, while our editorial will enhance OpenAI products"

- Bloomberg Deal: Expanded AI licensing rights for Dow Jones content

- Factiva GenAI: Expanded licensing rights from 8,000+ premium news sources

On concerns about AI tools like Claude Legal impacting Dow Jones: "Absolutely not. We are fully confident in the Dow Jones Professional Information business... we don't normally give forward guidance, but that's as much forward guidance you're gonna get, and it's particularly positive at this stage."

What Changed From Last Quarter?

Key improvements:

- Dow Jones B2B acceleration (+200 bps) driven by Risk & Compliance momentum

- HarperCollins rebounded with strong frontlist vs. sluggish Q1

- Realtor.com leads improved 13% with higher penetration of RealPro Select

- Share buybacks accelerated to $172M (4x prior year pace)

Capital Allocation and Buybacks

CFO Chandrashekar on buybacks: "We believe our stock remains materially undervalued relative to its net asset value... At the current stock price, we expect the rate of purchases will be higher in the second half, and the total dollars repurchased will be meaningfully more in the second half than in the first half."

The accelerated buybacks benefit from ~$380M in Foxtel shareholder loan repayments expected in FY2026.

How Did the Stock React?

NWSA shares fell 2.3% on the day of earnings release, closing at $24.21. The stock is trading:

- 7% below its 50-day moving average of $26.15*

- 13% below its 200-day moving average of $27.76*

- 23% below its 52-week high of $31.61*

*Values retrieved from S&P Global

The muted stock reaction despite the earnings beat likely reflects broader concerns about AI disruption in media/data sectors following recent DeepSeek-related volatility. Management addressed this directly, calling the AI threat to News Corp "a fundamental misconception."

What Did Management Guide?

While News Corp doesn't provide formal quarterly guidance, management offered qualitative commentary:

"Given the current trajectory of our core drivers, we believe prospects for the third quarter are auspicious."

Segment-specific outlook:

Moody's upgraded News Corp's outlook to positive, reflecting "the sturdiness of our balance sheet and strong operating performance."

Forward Estimates

*Values retrieved from S&P Global

Key Takeaways

-

Dow Jones is the crown jewel: Record margins (29.5%), accelerating B2B growth (12%), and expanding AI licensing deals position it as the primary value driver

-

AI is a tailwind, not a headwind: Management views content licensing as a major opportunity, with Anthropic settlement and ongoing OpenAI/Bloomberg deals expected to generate meaningful revenue

-

Digital Real Estate gaining share: Realtor.com's 10% growth and 3x traffic advantage vs. Homes.com suggest competitive positioning is improving despite weak housing market

-

HarperCollins recovery: Q2's 6% growth after a flat Q1 shows resilience, with multiple catalysts ahead (Pope Leo XIV book, Bridgerton Season 4)

-

Buybacks accelerating: Management clearly believes shares are undervalued and is putting capital to work at 4x prior year pace